Got some bucks sitting pretty in your Canadian account and thinking it’s about time they found their way into your GCash back home? Well, you’re in luck! We’ve got your back with a straightforward guide on how to cash-in your GCash in Canada. Whether you’re planning a big purchase or want to send some funds to your loved ones, we’ve got the steps to making it happen. Read on as we walk you through the simple steps to turn your Canadian cash into GCash funds. Let’s get started!

Can You Use GCash in Canada?

GCash is available to Filipinos in Canada as long as you have already registered an account and fully verified it using your Philippine SIM. Due to security reasons, users with no Philippine SIM have limitations when it comes to the features they can access when using GCash abroad. Those who have fully verified accounts with access to their Philippine SIM can use features like GInvest, Gstocks, and cashing out of their GCash account. These options are not available if you don’t have a Philippine SIM

How to Check Your Cash-in Options?

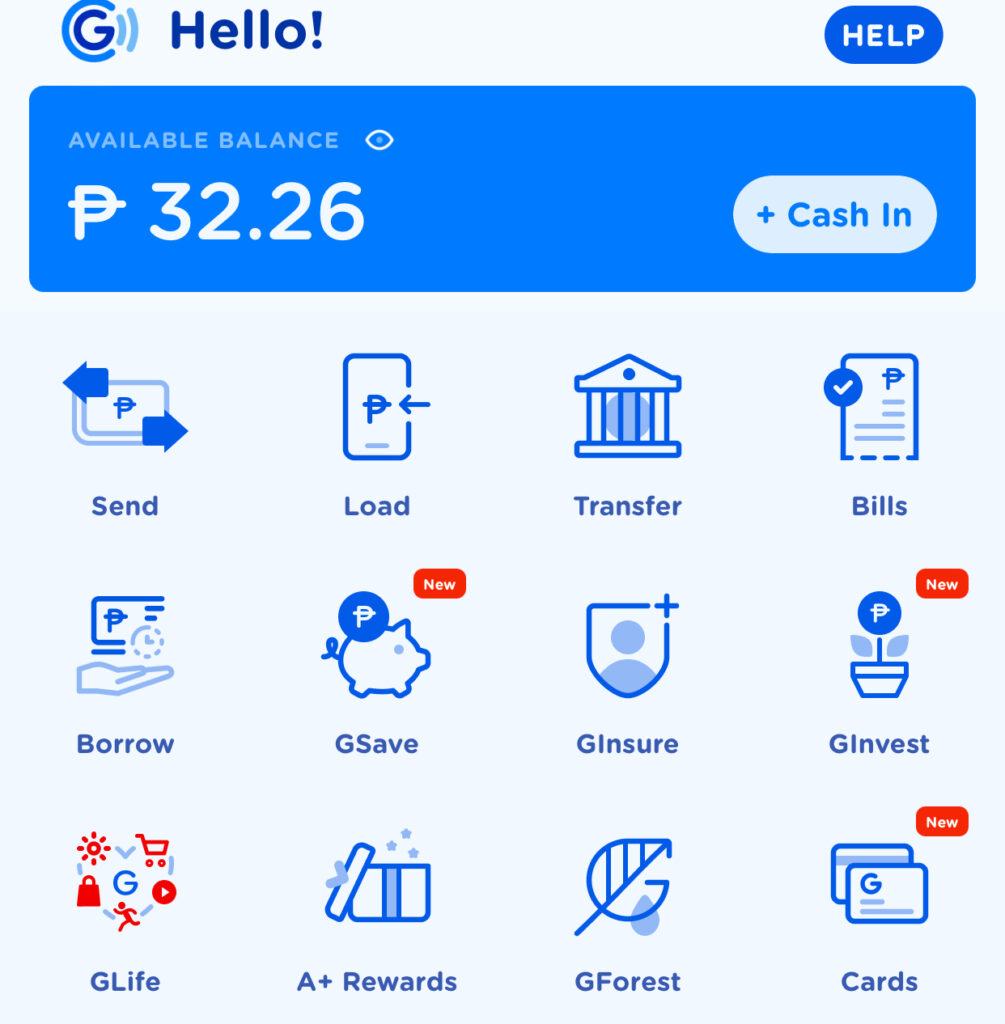

1. To cash-in money from Canada to your GCash account, go to your GCash app. Next to your balance, you should see the cash-in option.

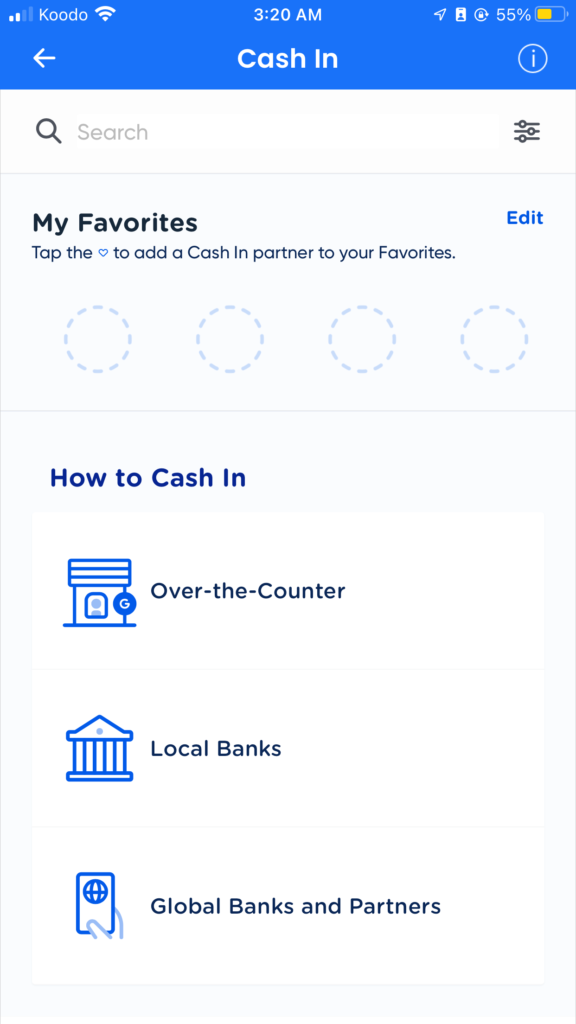

2. When cashing in from Canada, your choices are under the Global Banks and Partners option

3. By tapping Global Banks and Partners, you will see the different options for receiving money in your GCash account. Sending money from Canada to your GCash account is equivalent to sending remittances from Canada to the Philippines. In most cases, you will be paying service fees to your chosen remittance company.

Here are some of the GCash cash-in remittance partners who are available in Canada:

To cash in using the options below, you will need to create an account with each one.

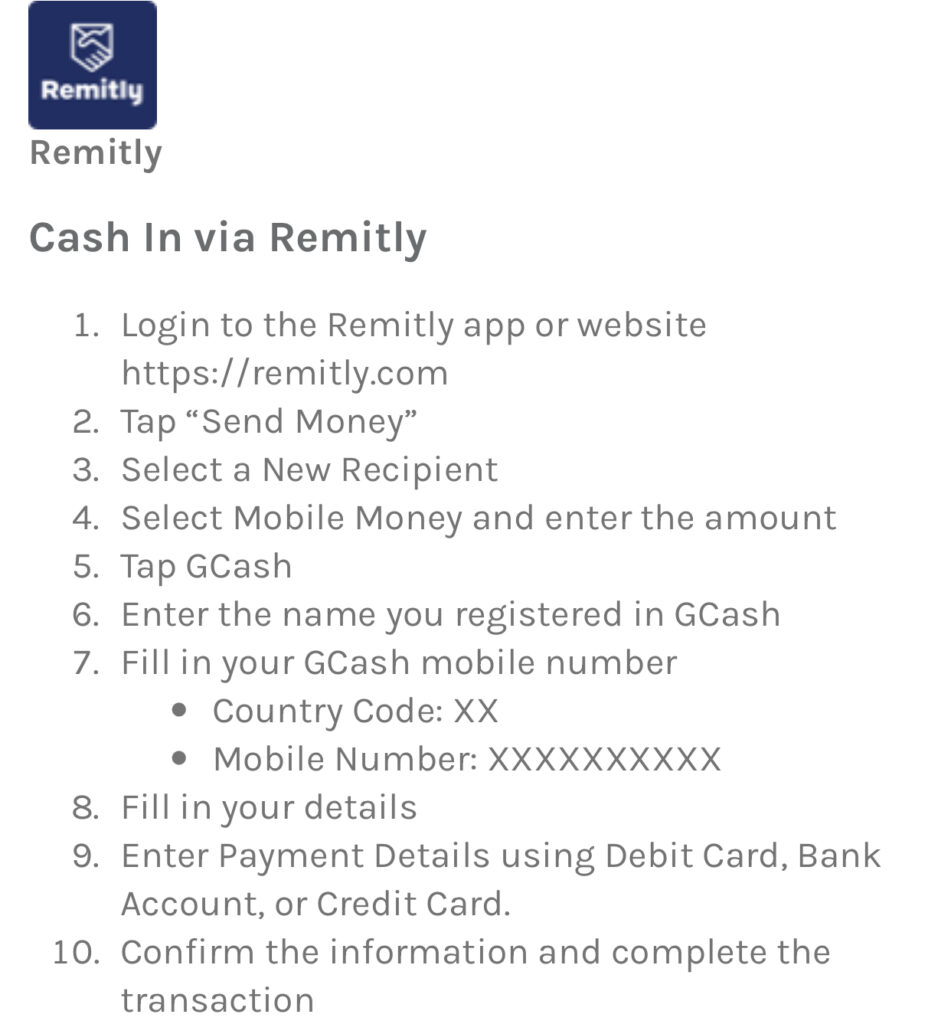

1. Remitly

- Login to the Remitly app or website

- Tap “Send Money”

- Select New Recipient

- Select Mobile Money and enter the amount

- Tap GCash

- Enter the name you registered in GCash

- Fill in your GCash mobile number

- Fill in your details

- Enter Payment details. You can use a Canadian debit card, bank account, or credit card.

- Confirm the information and complete the transaction.

Remitly will charge your Canadian bank, debit or credit account and convert it to Peso before sending it to GCash. The total amount deducted from your account will be the amount you transfer plus Remitly fees. Go to this page to check how much the exchange rate is for CAD to PHP and what the fees are for the transaction.

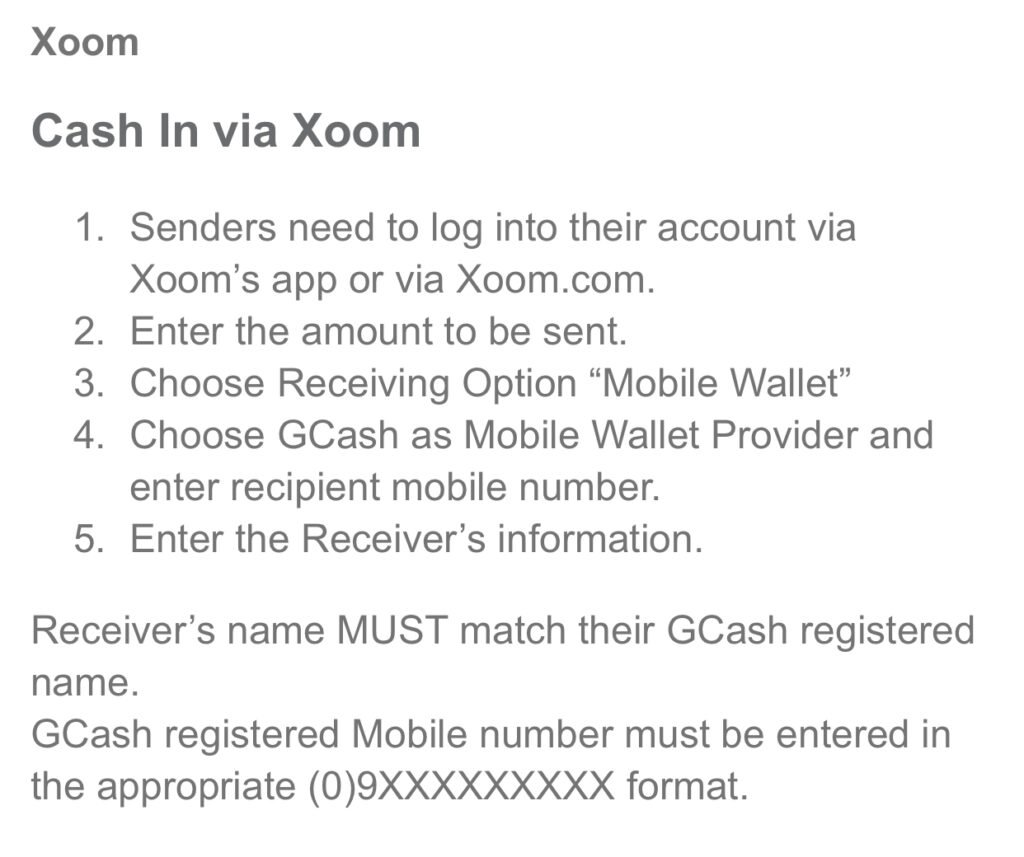

2. Xoom

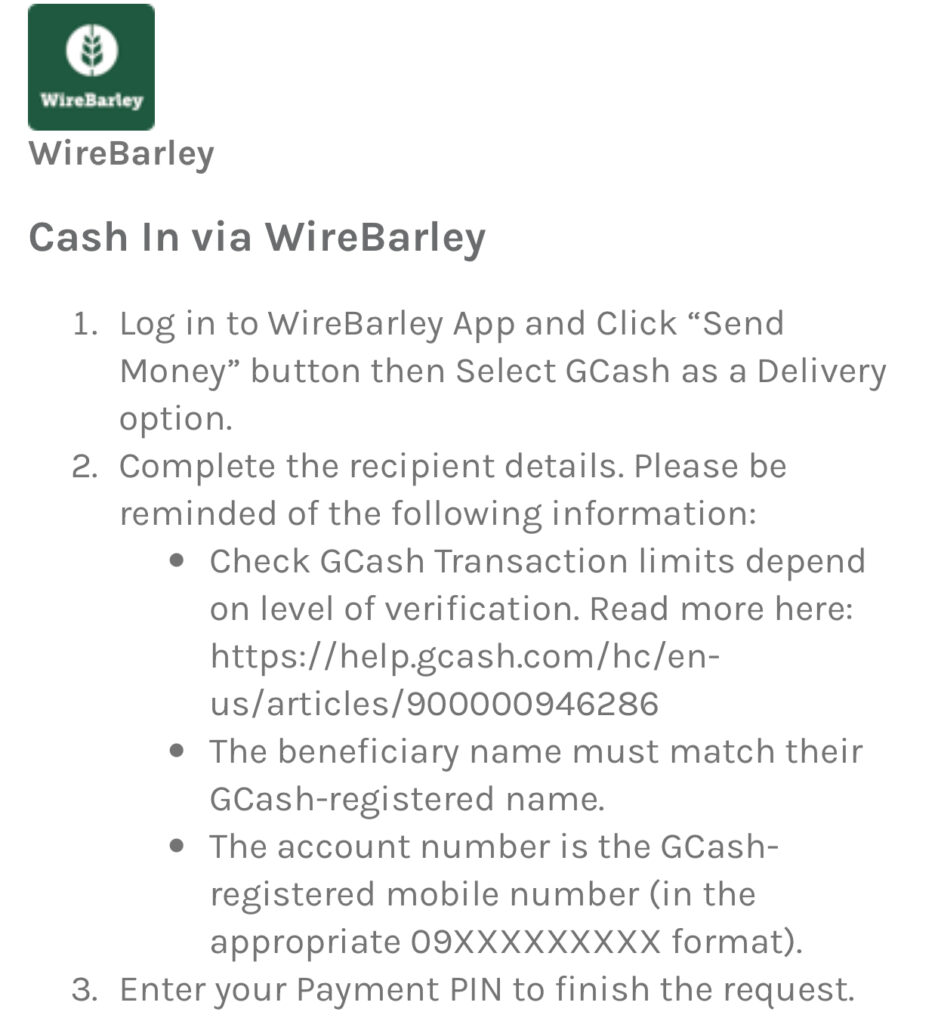

3. WireBarley

4. Wise (Formerly TransferWise)

Wise is one of the best companies I’ve personally used when transferring money internationally. I’ve used Wise to receive money from employers, send money to my own accounts, and use it to load my GCash accounts.

One of the biggest advantages of using Wise is that you get to control the timing of your conversion from CAD to PHP. With other remittance partners above, your exchange rate is dependent on the exchange rate of the platform. With Wise, you may choose to load your account today but wait for a favorable CAD-PHP exchange rate before converting your money.

To start, loading your GCash using Wise from Canada, follow these steps:

- Open and verify your Wise account. (Skip if you already have an account)

- Create a Canadian Dollar and Philippines Peso Account on your Wise.

- Add funds to your Canadian Dollar account using your Canadian debit or credit card.

- Convert CAD to PHP when you get a favorable exchange rate.

- Use the Send Money feature in your account to send Philippine Peso to your GCash.